If you want to save money, the best way to find the cheapest price for Hyundai Tiburon insurance in Tucson is to start comparing rates regularly from different companies in Arizona. You can shop around by following these guidelines.

If you want to save money, the best way to find the cheapest price for Hyundai Tiburon insurance in Tucson is to start comparing rates regularly from different companies in Arizona. You can shop around by following these guidelines.

First, get a basic knowledge of how insurance companies determine prices and the measures you can control to prevent expensive coverage. Many factors that result in higher prices like traffic violations, accidents, and a substandard credit history can be eliminated by improving your driving habits or financial responsibility.

Second, obtain price quotes from exclusive agents, independent agents, and direct providers. Direct and exclusive agents can only provide price estimates from a single company like Progressive or State Farm, while independent agents can provide prices for many different companies.

Third, compare the new rate quotes to your current policy to see if cheaper Tiburon coverage is available. If you find better rates and decide to switch, verify that coverage does not lapse between policies.

Fourth, give notification to your agent or company to cancel the current policy. Submit the signed application along with the required initial payment to your new insurance company. When you receive it, keep your new certificate verifying proof of insurance in an accessible location in your vehicle.

The most important part of shopping around is that you’ll want to compare identical coverage information on each quote and and to analyze as many companies as feasibly possible. This guarantees a level playing field and the best price quote selection.

Statistics show that most drivers in Arizona kept buying from the same company for at least four years, and almost half have never compared rates from other carriers. Many drivers in America can save hundreds of dollars each year by just comparing quotes, but they don’t know the amount of savings they would get if they just switched companies.

The purpose of this article is to familiarize you with how to get online quotes and some money-saving tips. If you currently have car insurance, you will definitely be able to shop for the lowest rates using this information. Nevertheless, Arizona drivers can benefit by having an understanding of how big insurance companies set your policy premium.

When price shopping your coverage, making a lot of price comparisons increases your odds of finding a better price.

The companies in the list below have been selected to offer free rate quotes in Tucson, AZ. If your goal is to find the best cheap auto insurance in Arizona, it’s a good idea that you visit two to three different companies in order to get a fair rate comparison.

Get Cheap Insurance Rates by Understanding These Factors

Lots of factors are used in the calculation when quoting car insurance. Some are pretty understandable like your driving record, although some other factors are more obscure such as your credit history or how financially stable you are.

- What are good liability protection limits? – Your insurance policy’s liability coverage will afford coverage if you are ruled to be at fault for personal injury or accident damage. It provides legal defense coverage which can cost a lot. This coverage is relatively inexpensive compared to other policy coverages, so do not cut corners here.

- Drivers with good credit save on insurance – Credit score can be a huge factor in calculating your premium rate. So if your credit score can use some improvement, you could be paying less to insure your Hyundai Tiburon by repairing your credit. People with excellent credit scores tend to be more responsible than those with poor credit.

- Urban areas may pay more – Living in a small town may provide you with better prices when trying to find low car insurance rates. Fewer drivers on the road means reduced accidents and lower theft and vandalism rates. Residents of big cities regularly have more auto accidents and much longer commute distances. More time commuting means a statistically higher chance of an accident.

- Car and home together may be cheaper – Most companies allow better rates to buyers who have multiple policies with them, otherwise known as a multi-policy discount. If you currently are using one company, it’s in your best interest to shop around to verify if the discount is saving money. It’s possible to still find better rates even if you insure with multiple companies

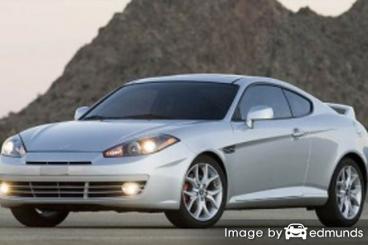

- Is your vehicle built for speed? – The performance level of the vehicle you are trying to find cheaper insurance for makes a big difference in how high your rates are. Economy passenger vehicles usually are quite affordable to insure, but the final cost of insurance is determined by many other factors.

Choosing vehicle insurance is an important decision

Despite the high cost, maintaining insurance is required for several reasons.

First, most states have mandatory liability insurance requirements which means you are required to buy specific limits of liability insurance coverage if you want to drive legally. In Arizona these limits are 15/30/10 which means you must have $15,000 of bodily injury coverage per person, $30,000 of bodily injury coverage per accident, and $10,000 of property damage coverage.

Second, if you took out a loan on your vehicle, most lenders will require you to buy insurance to ensure they get paid if you total the vehicle. If you cancel or allow the policy to lapse, the lender may insure your Hyundai at a more expensive rate and require you to pay for the much more expensive policy.

Third, auto insurance preserves your vehicle and your assets. It will also pay for medical bills for you, any passengers, and anyone injured in an accident. One policy coverage, liability insurance, will also pay to defend you if you are sued as the result of an accident. If mother nature or an accident damages your car, your policy will cover the damage repairs after a deductible is paid.

The benefits of carrying enough insurance more than offset the price you pay, particularly if you ever have a claim. The average driver in Arizona is currently overpaying as much as $800 each year so we recommend shopping around at every renewal to ensure rates are inline.

How to find a good Tucson auto insurance company

Finding a highly-rated insurer is difficult considering how many companies there are in Tucson. The rank data displayed below can help you choose which insurers you want to consider shopping your coverage with.

Top 10 Tucson Car Insurance Companies by A.M. Best Rank

- USAA – A++

- Travelers – A++

- State Farm – A++

- GEICO – A++

- Esurance – A+

- Nationwide – A+

- Allstate – A+

- Mercury Insurance – A+

- Progressive – A+

- Titan Insurance – A+