It’s safe to assume that insurance companies don’t want you comparing rates. Insureds who compare rates once a year will presumably buy a new policy because of the good chance of finding coverage at a more affordable price. A recent study showed that people who compared prices regularly saved over $865 annually as compared to drivers who never shopped for cheaper rates.

It’s safe to assume that insurance companies don’t want you comparing rates. Insureds who compare rates once a year will presumably buy a new policy because of the good chance of finding coverage at a more affordable price. A recent study showed that people who compared prices regularly saved over $865 annually as compared to drivers who never shopped for cheaper rates.

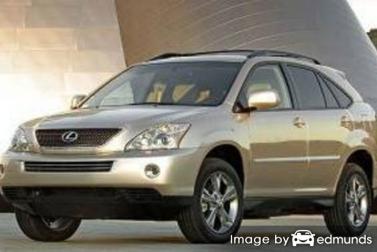

If finding the lowest rates on Lexus RX 400h insurance is why you’re here, then having an understanding of the best ways to shop for cheaper coverage can make it easier to shop your coverage around.

The best way we recommend to find the cheapest price for auto insurance rates is to compare quotes annually from insurers who can sell car insurance in Tucson.

- Try to learn about car insurance and the measures you can take to prevent expensive coverage. Many risk factors that drive up the price like at-fault accidents, careless driving, and a less-than-favorable credit score can be remedied by making minor changes in your lifestyle.

- Compare prices from direct carriers, independent agents, and exclusive agents. Direct companies and exclusive agencies can only quote rates from a single company like Progressive or Farmers Insurance, while agents who are independent can provide rate quotes for a wide range of insurance providers.

- Compare the new quotes to your current policy premium to see if switching to a new carrier will save money. If you find better rates and make a switch, make sure the effective date of the new policy is the same as the expiration date of the old one.

A valuable tip to remember is to compare identical limits and deductibles on each quote and and to look at as many companies as possible. This guarantees the most accurate price comparison and a better comparison of the market.

If you have car insurance now, you will most likely be able to get lower rates using the ideas presented in this article. Locating the best rates in Tucson can be much easier if you know how to start. But Arizona vehicle owners must learn the way companies sell insurance online and use it to your advantage.

Most larger insurance companies such as Allstate and Progressive allow consumers to get prices for coverage direct online. Getting online quotes for Lexus RX 400h insurance in Tucson is possible for anyone because you just enter your personal and coverage information as requested by the quote form. After the form is submitted, the quote system will order your driving record and credit report and returns a price based on many factors. Being able to quote online for Lexus RX 400h insurance in Tucson helps simplify price comparisons, and it’s very important to compare as many rates as possible if you want to get the most affordable auto insurance rates.

To find out how much you can save on auto insurance, compare rate quotes from the providers shown below. To compare your current rates, we recommend you input your coverages exactly as they are listed on your policy. This helps ensure you will have an apples-to-apples comparison using the exact same coverages.

The companies in the list below can provide free quotes in Arizona. If you wish to find cheap car insurance in Tucson, AZ, we suggest you click on several of them in order to get a fair rate comparison.

Car insurance policy discounts you can’t miss

Companies don’t necessarily list the entire discount list very clearly, so below is a list a few of the more common and also the lesser-known discounts that you may qualify for.

- Organization Discounts – Belonging to a qualifying organization could trigger savings on your next renewal.

- Full Payment Discount – If paying your policy premium upfront rather than paying in monthly installments you can avoid monthly service charges.

- Passive Restraint Discount – Factory air bags and/or automatic seat belt systems can receive discounts as much as 30%.

- E-sign Discounts – Many insurance companies will discount your bill up to fifty bucks for signing up over the internet.

- Telematics Data – Insureds who allow driving data collection to track when and where they use their vehicle by using a small device installed in their vehicle such as In-Drive from State Farm or Allstate’s Drivewise system might get better premium rates as long as they are good drivers.

- Defensive Driver Discount – Completing a course that instructs on driving safety could cut 5% off your bill if your company offers it.

- Discounts for Cautious Drivers – Drivers who avoid accidents could pay up to 40% less as compared to drivers with claims.

While discounts sound great, it’s important to understand that most discount credits are not given to all coverage premiums. Most only reduce the cost of specific coverages such as physical damage coverage or medical payments. So despite the fact that it appears adding up those discounts means a free policy, you’re out of luck.

Larger car insurance companies and their offered discounts include:

- American Family has discounts for good driver, good student, accident-free, Steer into Savings, and bundled insurance.

- State Farm policyholders can earn discounts including defensive driving training, Steer Clear safe driver discount, safe vehicle, driver’s education, multiple autos, and passive restraint.

- 21st Century may have discounts that include defensive driver, early bird, student driver, teen driver, and anti-lock brakes.

- Travelers may include discounts for IntelliDrive, multi-car, multi-policy, new car, and payment discounts.

- GEICO offers premium reductions for federal employee, membership and employees, defensive driver, five-year accident-free, driver training, and good student.

When quoting, ask all companies you are considering which discounts can lower your rates. Some of the earlier mentioned discounts may not apply to policyholders in Tucson.

Compare prices but still have a local neighborhood Tucson car insurance agent

Some consumers would rather have an agent’s advice and often times that is recommended An additional benefit of comparing rate quotes online is that you can find cheaper rates and still buy from a local agent.

To make it easy to find an agent, after completing this simple form, your information is submitted to participating agents in Tucson that can give you free Tucson auto insurance quotes for your insurance coverage. You don’t have to contact any agents due to the fact that quote results will go to the email address you provide. You’ll get the best rates and a licensed agent to talk to. If you wish to get a price quote from a particular provider, feel free to find their quoting web page and complete a quote there.

Selecting a provider requires you to look at more than just a cheap price. Any good agent in Tucson should know the answers to these questions.

- Are there any discounts for paying up front?

- When do they do a full risk review?

- How much can you save by raising your physical damage deductibles?

- Does the agency have a good rating with the Better Business Bureau?

- Do they reduce claim amounts on high mileage vehicles?

Auto insurance companies ranked

Finding the best insurance provider is difficult considering how many companies are available to choose from in Tucson. The company rank data listed below may help you select which providers to look at when comparing rate quotes.

Top 10 Tucson Car Insurance Companies Ranked by Claims Service

- State Farm

- Esurance

- AAA Insurance

- GEICO

- Liberty Mutual

- Progressive

- Allstate

- Titan Insurance

- The Hartford

- Mercury Insurance

What insurance coverages do you need?

Having a good grasp of your insurance policy helps when choosing the best coverages and the correct deductibles and limits. Policy terminology can be confusing and coverage can change by endorsement. Listed below are typical coverages found on the average insurance policy.

Comprehensive coverage (or Other than Collision) – This pays for damage that is not covered by collision coverage. You need to pay your deductible first and then insurance will cover the rest of the damage.

Comprehensive coverage pays for claims like rock chips in glass, theft and hitting a deer. The most you can receive from a comprehensive claim is the ACV or actual cash value, so if your deductible is as high as the vehicle’s value consider dropping full coverage.

Coverage for liability – This provides protection from damages or injuries you inflict on other’s property or people that is your fault. This coverage protects you against other people’s claims. Liability doesn’t cover your injuries or vehicle damage.

Coverage consists of three different limits, per person bodily injury, per accident bodily injury, and a property damage limit. As an example, you may have limits of 15/30/10 which stand for a limit of $15,000 per injured person, $30,000 for the entire accident, and property damage coverage for $10,000.

Liability coverage protects against claims like funeral expenses, emergency aid, legal defense fees, repair costs for stationary objects and court costs. How much liability should you purchase? That is up to you, but buy as much as you can afford. Arizona state minimum liability requirements are 15/30/10 but it’s recommended drivers buy better liability coverage.

The chart below shows why the minimum limit may not provide adequate coverage.

Uninsured Motorist or Underinsured Motorist insurance – Uninsured or Underinsured Motorist coverage gives you protection when the “other guys” are uninsured or don’t have enough coverage. It can pay for injuries sustained by your vehicle’s occupants and also any damage incurred to your Lexus RX 400h.

Because many people carry very low liability coverage limits (15/30/10 in Arizona), it only takes a small accident to exceed their coverage. That’s why carrying high Uninsured/Underinsured Motorist coverage should not be overlooked.

Collision coverage – Collision coverage covers damage to your RX 400h from colliding with an object or car. You first must pay a deductible and the rest of the damage will be paid by collision coverage.

Collision can pay for claims such as driving through your garage door, damaging your car on a curb and backing into a parked car. Paying for collision coverage can be pricey, so analyze the benefit of dropping coverage from older vehicles. Drivers also have the option to raise the deductible on your RX 400h to bring the cost down.

Insurance for medical payments – Med pay and PIP coverage kick in for immediate expenses like EMT expenses, pain medications, ambulance fees and funeral costs. They are utilized in addition to your health insurance policy or if you do not have health coverage. It covers all vehicle occupants as well as being hit by a car walking across the street. PIP is only offered in select states and gives slightly broader coverage than med pay

How much can you save?

As you quote Tucson auto insurance, it’s a bad idea to reduce needed coverages to save money. In many cases, an accident victim reduced comprehensive coverage or liability limits to discover at claim time that it was a big error on their part. Your objective should be to purchase a proper amount of coverage for the lowest cost and still be able to protect your assets.

In this article, we covered a lot of ways to find cheap Lexus RX 400h insurance in Tucson. The most important thing to understand is the more price quotes you have, the higher your chance of finding cheaper Tucson auto insurance quotes. You may even find the lowest priced car insurance comes from a smaller regional carrier. Some small companies can often insure niche markets at a lower cost than their larger competitors like Allstate, GEICO and Progressive.

Additional information is located below:

- How Does Hitting a Deer Impact Insurance Rates? (Allstate)

- Who Has the Cheapest Car Insurance Quotes for College Graduates in Tucson? (FAQ)

- Five Steps to Filing an Auto Insurance Claim (Insurance Information Institute)

- Air Bags: Potential Dangers to Your Children (Insurance Information Institute)

- Auto Insurance 101 (About.com)